Because of market-wide recession fears that outweighed a fundamentally constrained supply market, oil saw its worst trading day in nearly three months in September 2022. The settlement price for West Texas Intermediate oil futures was below $100 after the commodity dropped by more than 8%, the most since March 9. Markets became risk-averse due to growing worries that a global economic slowdown may ultimately hurt demand.

Since traders left the market in the wake of Russia's invasion of Ukraine, which reduced liquidity, oil prices have been prone to abrupt swings. The most recent decline occurred as the dollar rose and stocks declined. In the case of a recession, crude could drop to $65 this year, according to Citigroup Inc.

Worldwide response

Barron/ Getty Images | Oil prices fell on Wednesday as a renewed fear of recession

Many central banks worldwide plan to keep raising interest rates to combat inflation, but according to experts, the United States seems better prepared to weather the storms. Due to this, the dollar has reached a 24-year high against the yen and a 37-year high against the pound. Since most global oil sales are conducted in dollars, the higher currency puts pressure on oil prices.

Why is this happening?

Numerous factors are "keeping a lid on costs," and as a result, Europe is making vigorous efforts to reduce its dependency on Russian gas and locate alternate energy sources, including Norway. There is a looming prospect of price caps, either from the G7 on Russian oil or from the EU on Russian gas, given that Russia is moving to other purchasers for oil like India and China.

As a result of the country's zero-Covid policy, which has resulted in full or partial lockdowns in more than 70 cities since late August, global energy consumption is easing, particularly in China, where crude oil imports plummeted 9.4% last month compared to a year earlier.

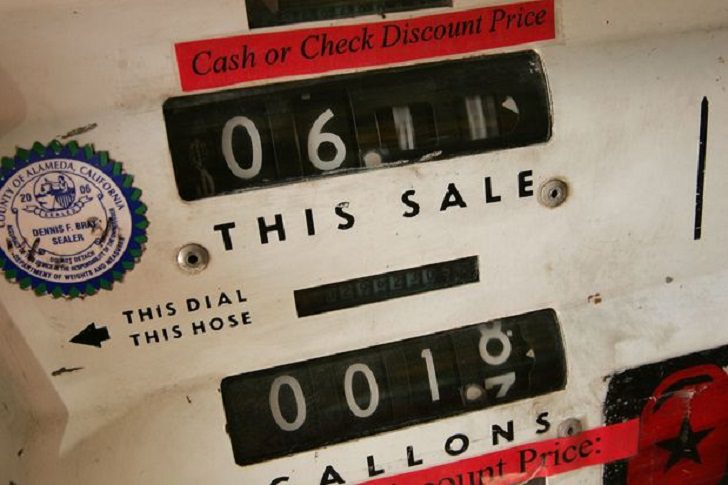

Mario Tama/ Getty Images News | Getty Images | The US national average petrol price has fallen sharply in recent weeks to $3.76 a gallon after topping $5 a gallon in June

What’s next

On September 21, there will be a meeting of the US Federal Reserve. As anticipated, the Bank of Canada increased interest rates on Wednesday by three-quarters of a percentage point to a record high. The bank also predicted that the policy rate will need to increase as it confronts runaway inflation.

The price swings since the Ukraine conflict began six months ago have rattled hedge funds and speculators and thinned trading, which in turn has made the market whipsaw even more, as seen on Tuesday. Russian action on natural gas lent further support. Gazprom halted natural gas flows through Europe’s key supply route on Wednesday as the economic battle intensified between Moscow and Brussels.

Bottom line

REUTERS/ Nick Oxford/ File Photo | The dollar index, which tracks the greenback against a basket of currencies, has hit a two-decade high

The oil market is in freefall as crude prices suffer significantly from their rapid decline. It seems that the possibility of losing the Russian energy supply is no longer supporting oil prices. The outlook for global growth is really bleak, which is problematic for crude prices. Given the continued strength of the U.S. economy and the fact that most of the demand shock from China's deteriorating Covid situation has been priced in, domestic oil prices could stay around $80 per barrel.